How to Spend Money Wisely as a College Student

As a student, we have a limited amount of money to spend in college. To minimize our expenses, we need a plan or strategy.

There Are 7 ways given below:

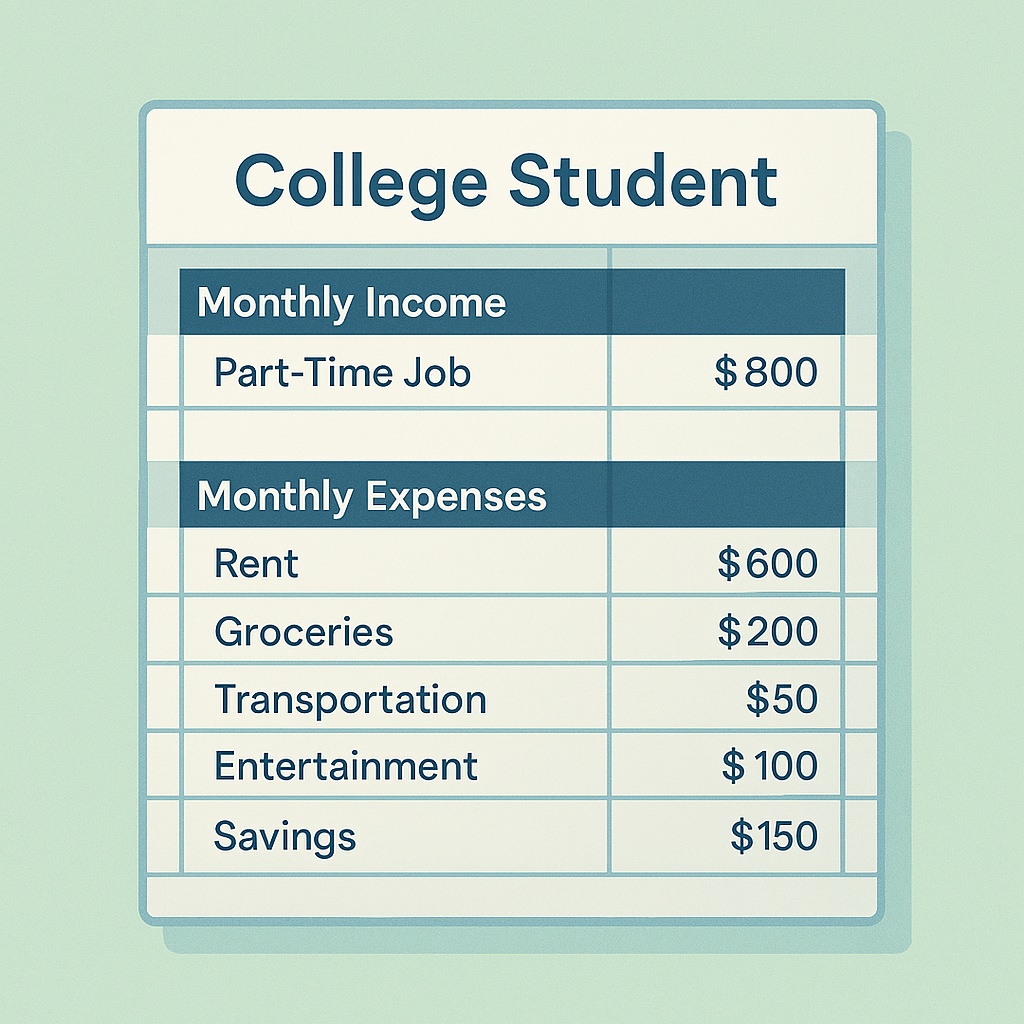

1. Create a Realistic Budget For College Expenditure

The first step is to create a realistic budget. This might seem difficult, but it’s simpler than you think. Here’s how to get started:

Estimate Your Monthly Income

calculate total amount of money coming per month. This can include :

- Student loans

- Scholarships and grants

- Part-time job earnings

- Contributions from parents or savings

Sum up all these to get your total monthly income.

Calculate Your Monthly Expenses In College

Next, write down all your expenses that you can’t avoid , such as:

- Rent (if living off-campus)

- Tuition and fees (if not covered by loans or scholarships)

- Textbooks and school supplies

- Groceries

- Utilities

- Transportation costs

Be as accurate as possible when estimating these expenses. Look at past bills or research average costs in your college town if you’re unsure.

Write down additional Expenses

Now, consider your discretionary spending. This includes things like:

- Eating out

- Entertainment (movies, concerts, etc.)

- Clothing

- Personal care items

- Hobbies

Remember, We can always save money from above things like

- We can eat less number of times

- We can enjoy movies and shows on our laptops instead of going to theaters and concerts

- Buy cheap but good clothes

- We can use limited amount of personal care

Make budget for Savings, splurges and Emergencies

Don’t forget to save some money for:

- Savings: Even small amounts can add up over time

- Occasional splurges: Allow yourself some treats to avoid feeling deprived

- Emergency fund: For unexpected expenses or opportunities

By allocating funds for these categories, you’ll be better prepared for both the expected and unexpected costs of college life.

2. Track Your Expenses

Once you’ve created your budget, it’s important to track your actual spending. This will help you understand where your money is really going and identify areas where you might be overspending.

Record Every Expense for the First Month

For at least the first month, write down every single purchase you make. This includes everything from purchasing morning coffee to night toothpaste. This will help you to realize how much money you spend on big or small things in your daily life.

Use a Budgeting App or Spreadsheet

To make tracking easier, consider using a budgeting app like Mint, YNAB (You Need A Budget), or PocketGuard. These apps can often link to your bank account and automatically categorize your expenses.

If you prefer a more hands-on approach, create a simple spreadsheet to log your expenses. Here’s an example of how you might set it up:

| Date | Category | Description | Amount |

|---|---|---|---|

| 9/1/25 | Groceries | Weekly shop | 700 |

| 9/2/25 | Entertainment | Movie ticket | 700Rs |

| 579 | Textbooks | Chemistry book | 579Rs |

Adjust Your Budget Based on Actual Spending Patterns

After tracking your monthly expenditure, compare your actual spending to your initial budget. You may need to make some adjustments. Perhaps you’re spending more on entertainment than you thought but less on eating. Use this collective information to create a more accurate budget for the following month. This revised budget should reflect your priorities and help you allocate funds more effectively.

3. Review Your Budget Regularly

Your budget isn’t a “set it and forget it” tool. You need to regularly review your monthly expenditure.

Schedule Weekly Budget Reviews

Set aside time each week or every other week to review your spending and see how it aligns with your budget. This doesn’t have to be a long process – even 15-20 minutes can be enough to keep you on track.

Identify Areas Where You Can Save Some Money

If you find you’re consistently overspending in certain categories, look for ways to cut back. Some ideas include:

- Cooking more meals at home instead of eating out

- Finding free entertainment options on campus

- Using public transportation instead of driving

- Buying used textbooks or renting them

- Use a cycle on a college campus.

Look for Ways to Reduce Required Expenses

Don’t assume your fixed expenses are set in stone. There may be ways to reduce these costs:

- Consider a cheaper meal plan if you’re not using all your meals

- Look for student housing options that include utilities

- Buying used textbooks or renting them

- Shop when there are shopping deals

Remember, even small savings can add up over the course of a semester or academic year.

4. Utilize Student Discounts and Campus Facilities

One of the perks of being a college student is access to numerous discounts and free resources. Make the most of these to stretch your budget further.

Take Advantage of Student Discounts

Many businesses offer discounts to college students. Always carry your student ID and don’t be afraid to ask if a discount is available. Some common places to find student discounts include:

- Restaurants and cafes

- Movie theaters

- Museums and cultural attractions

- Clothing stores

- Technology retailers

Pro tip: Look for apps like UNiDAYS or Student Beans that aggregate student discounts in one place.

Maximize the Use of Campus Facilities

Your tuition and fees often give you access to a wide range of campus facilities. Make the most of these to save money:

- Use the campus gym instead of paying for a separate gym membership

- Take advantage of free events and activities on campus for entertainment

- Use the campus library for studying and accessing resources instead of buying books

- Utilize campus computer labs instead of buying your own printer

Split Costs with Roommates

If you’re living with roommates, look for ways to share expenses:

- Split the cost of shared items like cleaning supplies or toilet paper

- Share streaming service subscriptions

- Take turns cooking meals to save on groceries and eating out

By sharing costs, you can often access more amenities or services than you could afford on your own.

5. Manage Your Spending

How you handle your day-to-day spending can make a big difference in your overall financial health. Here are some strategies to help you manage your money more effectively:

Use Credit Cards Wisely

Credit cards can be useful tools, but they can also lead to debt if not used responsibly. Here are some guidelines:

- Choose a card with a low credit limit to prevent overspending

- Pay off the full balance each month to avoid interest charges

- Use the card for budgeted expenses only, not for impulse purchases

- Take advantage of cashback or rewards programs, but don’t let these tempt you into unnecessary spending

Avoid Impulse Purchases and Retail Therapy

It’s easy to fall into the trap of impulse buying, especially when you’re stressed or feeling down. To avoid this:

- Wait 24 hours before making any non-essential purchase

- Unsubscribe from marketing emails that tempt you to spend

- Find non-monetary ways to treat yourself or manage stress, like exercise or spending time with friends

Make Shopping Lists and Stick to Them

Whether you’re grocery shopping or buying school supplies, always make a list before you go. This helps you:

- Stay focused on what you actually need

- Avoid impulse purchases

- Compare prices to get the best deals

Distinguish Between Essential and Non-Essential Expenses

When making purchasing decisions, always ask yourself, “Is this essential?” Be honest with yourself about what you truly need versus what you simply want. This doesn’t mean you can never buy non-essential items, but being aware of the difference can help you make more mindful spending choices.

6. Pay Bills on Time

Staying on top of your bills is crucial for maintaining a healthy financial life in college. Here’s how to make sure you never miss a payment:

Set Reminders for Billing Dates

Use your phone’s calendar or a planner to set reminders for when bills are due. Set the reminder a few days before the actual due date to give yourself time to make the payment.

Pay Bills as Soon as You Receive Income

Whenever possible, pay your bills as soon as you receive money. This ensures that your essential expenses are covered before you’re tempted to spend on non-essentials.

Avoid Late Fees and Surcharges

Late fees can quickly add up and derail your budget. Plus, consistently late payments can negatively impact your credit score. Make it a priority to pay all bills on time to avoid these unnecessary costs.

7. Explore Money-Saving Strategies

There are countless ways to save money in college. Here are some strategies to consider:

Buy Used Textbooks or Rent Them

Textbooks can be one of the biggest expenses for college students. To save money:

- Buy used books from the campus bookstore or online marketplaces

- Rent textbooks for the semester

- Look for digital versions, which are often cheaper

- Share textbooks with classmates if possible

Purchase Supplies in Bulk or Share with Roommates

For items you use regularly, buying in bulk can often save money in the long run. This works especially well if you can split the cost with roommates. Consider bulk purchases for:

- Toiletries

- Cleaning supplies

- Non-perishable food items

Enroll in a Meal Plan (If Cost-Effective)

Carefully consider whether a meal plan makes sense for you. Compare the cost of the meal plan to how much you’d spend on groceries and cooking for yourself. Keep in mind:

- The convenience factor of not having to cook

- Any restrictions on when and where you can use your meal plan

- Whether you’ll actually use all the meals provided

FAQ

1. What is the main focus of the budget?

A budget is a spending plan that maps out the amount of income versus the amount of expenses over a specific period of time. Typically a budget is prepared for an entire month.

2. How do I start creating a budget?

- List your income (like scholarship , loans, parental support, part time job).

- Track your expenses ( variable expenses like eating out, watching movies in a threater, travelling, and fixed expenses like rent and tution fee etc).

- Set spending limit .

- Review your expenses regulaly.

- You can also use budgeting tools (like Mint, YNAP or a simple spreadsheet).

3. How can I reduce my expenses as a college student?

- Cook meals instead of going out.

- Instead of buying books , rent them.

- Share housing cost with roommates.

- Use student discount (In transportation, software, entertainment).

- Use college gym instead of going private gym.

- Limit unnecessary subscription(streaming, entertainment).

4. How much should I save each month?

Aim to save around 15-20% of your income (if possible). Even small amounts can add up for emergencies and future goals.

5. How do I handle unexpected expenses?

- Use student resources(emergency aids , student loans)

- Build an emergency fund (starting by saving some money from your income)

- Avoid high interest credit cards.

- avoid taking loans with high interest.

6. Is using credit card as a student good?

You can use credit card only if you can pay it off monthly to avoid its debt. Look for student cards with no fees and cashback rewards.

7. Why should you create a college budget?

- Track where your money goes ( from small small purchases to big purchases).

- Avoid running out of your funds during college times.

- Reduce financial stress( If you knew where your money goes and how much money you left reduces stress).

- You can also save money for emergencies and future goal or you can spend on vacations.

Note : YOU CAN ALSO CONTACT US FOR MORE INFORMATION ABOUT HOW TO MAKE EFFECTIVE COLLEGE BUDGET: Click here

This is very useful website for students

good knowledge

Yes

Vvvvvvvv

Frthgg

Sdfgyy